It’s one of the most common financial questions:

“Should I start saving, or focus on paying off my debt first?”

It’s a tough choice, especially when you’re living paycheck to paycheck. On one hand, debt costs you interest. On the other, having no savings leaves you vulnerable to emergencies — which often just create more debt.

The truth?

It’s not about choosing one or the other. It’s about finding the right balance for your situation.

Why Some Experts Say Pay Off Debt First

High-interest debt (especially credit cards) can snowball fast. For every month you carry a balance, your interest grows — and you pay more over time.

The benefits of focusing on debt:

- Less money lost to interest

- Fewer monthly bills to juggle

- Emotional relief as you reduce what you owe

Example:

If you’re paying 20% interest on a credit card and saving money in a bank account that earns 1%, you’re losing 19% by keeping that balance around.

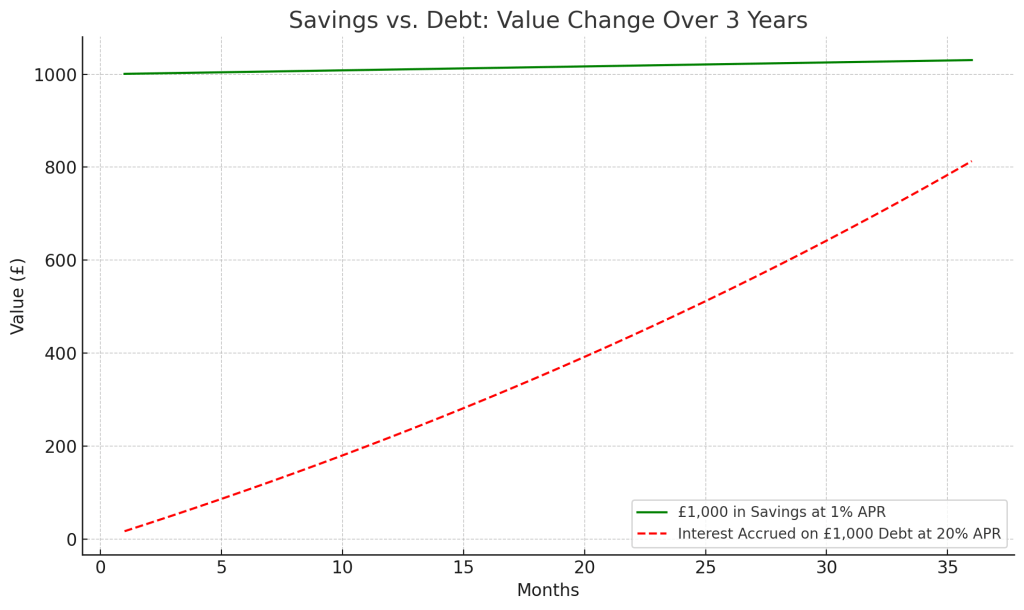

Here’s the extended graph showing what happens to £1,000 over 3 years:

- Savings at 1% APR grows very slowly — reaching just over £1,030.

- Debt at 20% APR grows rapidly — costing over £800 in interest if left unpaid.

This clearly shows how interest compounds against you when in debt, and why clearing high-interest balances often outweighs low-yield savings — unless you’re building a basic emergency fund.

Why Other Experts Recommend Saving First

Life is unpredictable. If you have no buffer, one unexpected cost — a car repair, dental bill, or job loss — can push you deeper into debt.

That’s why many personal finance pros suggest building a starter emergency fund, even while paying off debt.

The benefits of saving first:

- Cushion against emergencies

- Avoiding more debt

- Peace of mind

Even just £500–£1,000 can keep you from needing to rely on credit cards again.

How I Balanced Both

When I first started my financial journey, I had debt in multiple places and barely any savings.

I decided to put £500 aside first. It wasn’t easy, but it made me feel safer. Then I focused fully on debt repayment — only contributing small amounts to savings until I was in a better place.

That buffer helped me stay motivated and avoid “emergency panic” spending.

So… Which Should You Do First?

Here’s a simple framework:

1. If you have no savings at all:

Build a small emergency fund first (e.g. £500–£1,000).

This gives you breathing room and avoids future debt.

2. If you have some savings and high-interest debt:

Pause saving and focus on debt repayment.

Your money will go further by reducing what you owe.

3. If your debts are lower interest or long-term (like student loans):

Split your strategy. Keep saving while paying extra toward debt.

Final Thoughts

You don’t need to do everything at once — but you also don’t need to choose only one goal.

Start small. Focus on stability.

Once you build a little buffer, you’ll feel stronger and more capable of tackling your debt for good.

Leave a comment