When I first started budgeting, I thought I had to get everything perfect.

Spreadsheets, percentage rules, rigid categories — the works. But no matter how many plans I made, something always knocked me off track. A forgotten subscription. A surprise night out. Or just plain fatigue.

Eventually, I realised something that changed everything:

Tracking your spending is more powerful than creating the “perfect” budget.

Here’s why focusing on awareness — not perfection — can completely change how you manage your money.

Budgeting Without Tracking Is Like Driving With Your Eyes Closed

You can make a flawless monthly budget…

But if you’re not tracking where your money actually goes, that budget becomes a guess — not a tool.

Tracking your spending brings clarity, and with clarity comes control.

It lets you ask:

- “Why do I always overspend halfway through the month?”

- “What subscriptions am I paying for but not using?”

- “Is my food budget really realistic — or just wishful thinking?”

You can’t adjust what you don’t measure.

The Psychology: Why Awareness Changes Everything

Most people don’t overspend because they’re reckless — they overspend because they’re unaware.

When you track your spending:

- You see where your money goes in real time

- You spot patterns that don’t align with your goals

- You make more conscious decisions — even before you swipe your card

In psychology, this is called behavioural feedback. When you get real-time feedback on your actions, your brain naturally starts to self-correct. Tracking activates that.

My Turning Point: The £4 Here, £6 There Trap

When I was in the thick of my debt journey, I didn’t think I spent much on “non-essentials.”

But when I started tracking everything — literally every pound — I noticed something. I was spending £4 here, £6 there, £8 on “just one treat.” Over the month, it added up to over £150. Not on big purchases, but on moments I barely remembered.

That’s when it hit me: I didn’t need a tighter budget. I needed a better understanding of my habits.

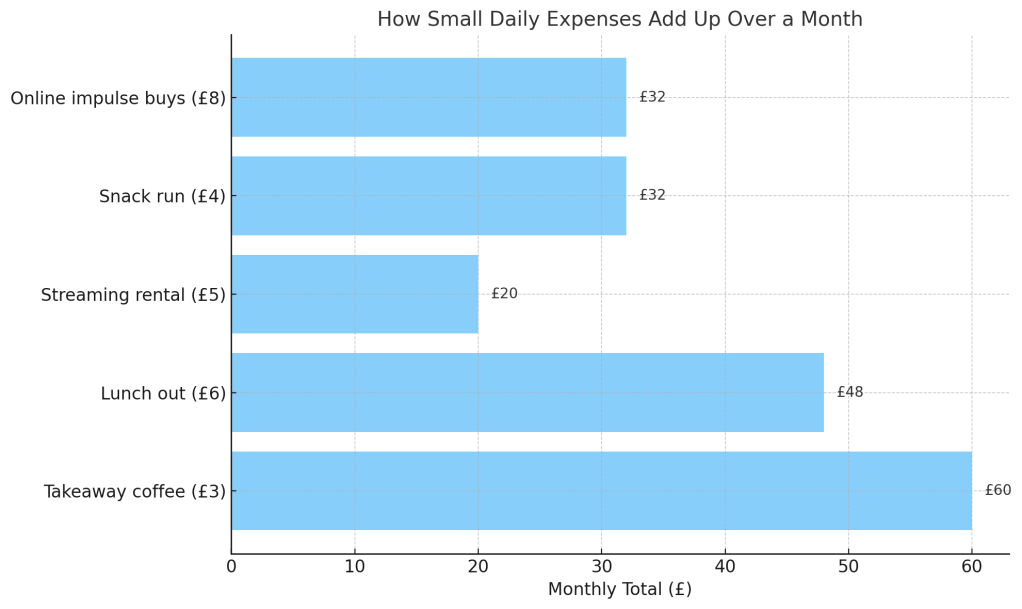

Here’s a visual showing how small daily expenses add up over the course of a month:

- Takeaway coffee: £60/month

- Lunch out: £48/month

- Streaming rental: £20/month

- Snack runs: £32/month

- Online impulse buys: £32/month

That’s £192/month on things many people barely notice.

What You Should Track (Even If It Feels Boring)

You don’t need a fancy system. Just consistency.

Start by tracking these:

- Every single transaction — no matter how small

- Cash, card, and online payments

- Recurring subscriptions and bills

- Unplanned expenses (they tell you where to adjust next)

Apps like Pocketsmith, Emma, or even a simple spreadsheet work well. Use whatever you’ll actually stick with.

Don’t Let Imperfection Stop You

You’re going to miss a receipt. Forget a £1 charge. Get tired of logging your lunch. That’s okay.

Tracking isn’t about being flawless — it’s about building awareness over time.

Even if you only track 80% of your spending, you’ll learn more about your habits than you ever would from a perfectly structured but disconnected budget.

Final Thoughts

A budget is a plan.

Tracking is what makes that plan real.

If you’ve struggled to stick to a budget, don’t give up. Shift your focus. Start by simply tracking where your money goes — with honesty, not shame.

Once you can see it, you can change it.

Leave a comment