When you’re juggling multiple debts, it’s tempting to stick to the minimum monthly payments just to stay afloat. But minimum payments are designed to benefit lenders — not you.

In fact, paying the bare minimum can stretch your repayment timeline by years and cost you thousands in interest.

The Psychology of the Minimum

Minimum payments create the illusion of progress. You feel like you’re “doing enough” — but your balance barely budges. Psychologically, this keeps you in the cycle of debt fatigue.

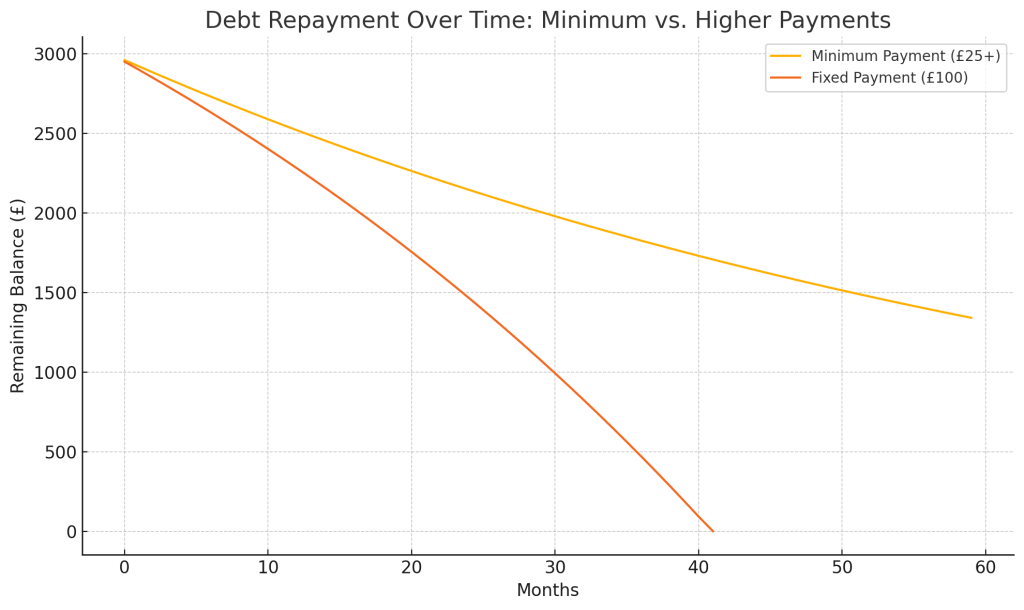

It’s similar to what we’ve discussed in The Psychology of Budgeting and Spending: when you don’t see visible change, your brain loses motivation. That’s why visual tools like progress trackers or graphs (like the one above) help keep you focused.

What Does “Minimum Payment” Really Mean?

Let’s break it down.

A typical credit card minimum is around 3% of the balance or £25, whichever is greater. For a £3,000 debt at 20% interest:

- Minimum Payment (£25–£90 range):

Takes years to repay

Costs over £1,200 in interest - Fixed Payment (£100/month):

Debt cleared in just over 3 years

Saves hundreds in interest

See the graph above for a real comparison.

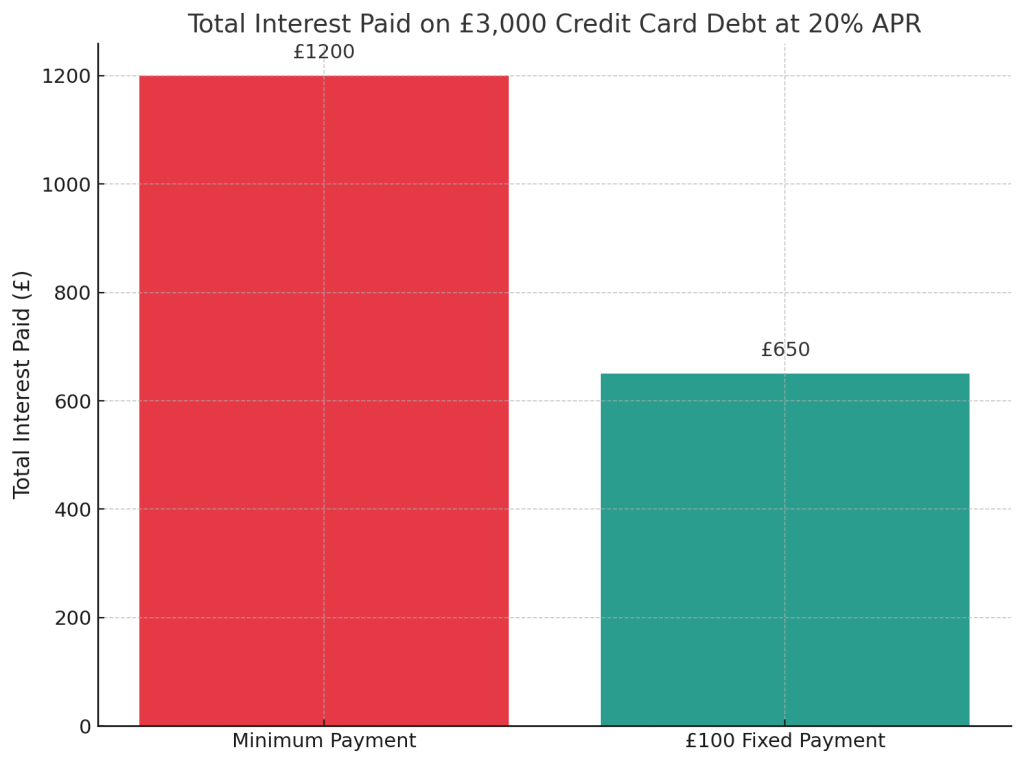

Here is a comparison chart showing the total interest paid on a £3,000 credit card debt at 20% APR using two strategies:

- Minimum Payment: £1,200 in interest

- £100 Fixed Payment: £650 in interest

This clearly shows how paying just a bit more than the minimum each month can significantly reduce the interest you pay overall.

Should You Pay More on All Debts or Focus on One?

This is where strategy comes in. There are two main approaches:

1. Pay a Little Extra on All Debts

This reduces interest across the board and keeps all balances shrinking. It’s steady but can feel slow.

2. Focus on One Debt at a Time (Snowball or Avalanche)

Pay the minimum on all but one, then funnel extra money toward that target. Once it’s paid off, redirect the freed-up payment toward the next debt — accelerating your momentum.

This method offers psychological wins, reinforcing progress with every paid-off balance.

👉 Learn more in: Snowball vs. Avalanche: Which Debt Strategy Is Right for You?

So, What’s the Best Move?

- If you’re overwhelmed, start small — even £10 over the minimum makes a difference.

- If you need motivation, focus on one debt and celebrate the milestones.

- And if you can, track your progress visually to stay motivated.

Final Thought

Minimum payments are a trap. They keep you “treading water” without ever swimming forward.

But with the right mindset, small overpayments, and a clear strategy, you can break the cycle — and finally move toward financial freedom.

Leave a comment