Budgeting doesn’t have to be boring or restrictive. A good budget isn’t about cutting everything out — it’s about gaining control, clarity, and confidence over your money.

If you’ve ever started a budget and given up a few weeks later, you’re not alone. But with the right strategy, budgeting can become a habit you actually enjoy.

Here’s how to build a budget that works in real life — even if your income varies or your expenses feel unpredictable.

Step 1: Know Your Numbers

Before you create a budget, you need to understand where your money is currently going.

Track your spending for at least a month:

- Use an app like PocketSmith, Emma, or Money Dashboard

- Review your bank and credit card statements

- Categorise expenses (e.g., groceries, rent, travel, subscriptions)

Pro tip: Look for patterns — where are you overspending without realising it?

Step 2: Calculate Your Income (After Tax)

Use your net (take-home) pay, not your gross salary. If your income fluctuates:

- Average the last 3 months of earnings

- Or use your lowest-earning month to stay conservative

This gives you a realistic and sustainable starting point.

Step 3: List Your Essential Expenses

These are your non-negotiables:

- Rent or mortgage

- Utilities

- Food and transport

- Debt repayments

- Insurance

Subtract these from your income. The remainder is what you can use for flexible spending and financial goals.

Step 4: Set Spending and Saving Goals

This is where you personalise your budget:

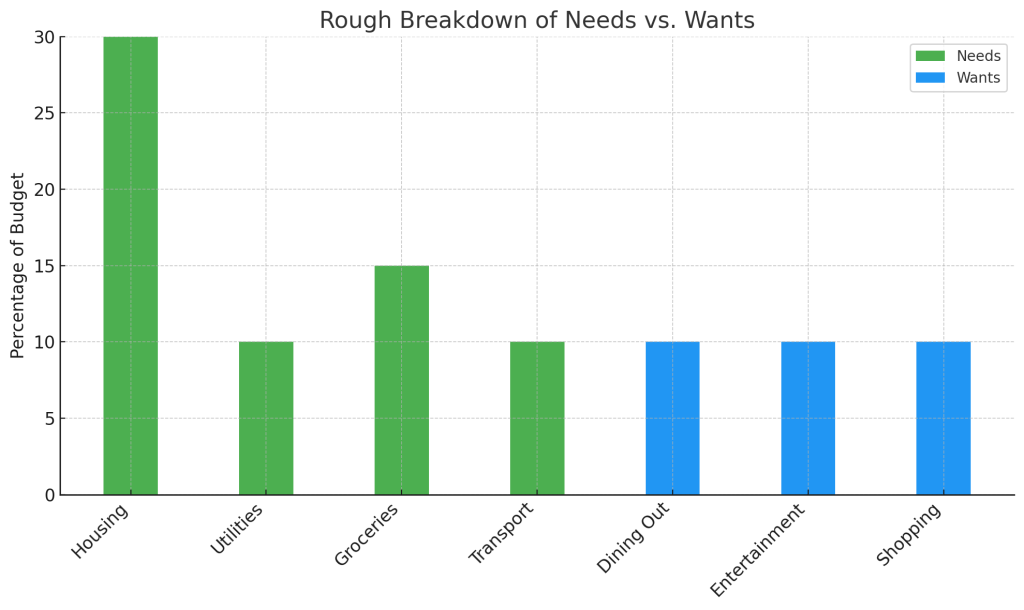

- Set limits for non-essentials like dining out, entertainment, or subscriptions

- Assign a portion of your budget toward savings or debt repayment

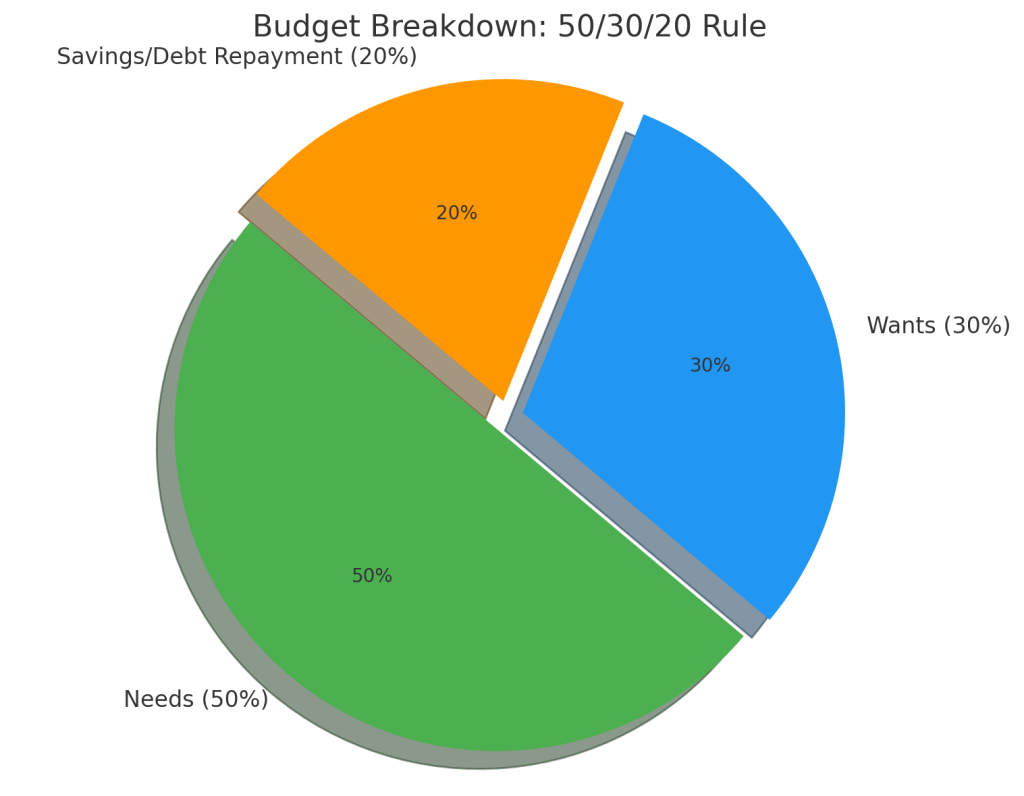

Use the 50/30/20 Rule as a rough guide:

Note:

This graph adds up to 95% on purpose. The remaining 5% is left as a buffer — a bit of playroom in your budget. Life is unpredictable, and building in a small margin helps absorb surprises without derailing your progress.

This flexibility makes your budget more sustainable long-term, especially when you’re just starting out or adjusting to a new system.

But don’t feel restricted — adjust based on your own situation.

Step 5: Choose a Budgeting Method That Works for You

Different people thrive with different approaches. Try one of the following:

- Zero-based budgeting: every pound is assigned a job

- Envelope method: physical or digital categories for spending

- Pay yourself first: save before you spend anything else

Try a method for one full month, then evaluate and adapt as needed.

Step 6: Review and Adjust Weekly

Many people abandon their budgets because they don’t review them.

Instead:

- Do a quick check-in once a week (15 minutes is enough)

- Ask: Did I stick to my categories? What worked or didn’t?

- Make small adjustments based on what’s happening in your life

Your budget is a living system — not something you set and forget.

What Helped Me Finally Understand Budgeting

I’ll be honest — I used to think budgeting was boring. It felt like spreadsheets, restrictions, and rules I didn’t want to follow. I thought it meant cutting out everything I enjoyed.

But once I actually tried it, I realised budgeting was the exact opposite.

It didn’t take long to see the benefits. I could finally see:

- Where my money was going

- Where I could cut back (without feeling deprived)

- How much I could afford to put toward paying off debt

That last one was huge.

Once I had a clear budget, I started using the snowball method — focusing on my smallest debt first while making minimum payments on the rest. Every time I paid something off, I’d roll that amount into the next debt.

And because I had a handle on my wants vs. needs, I could do it without panic or burnout.

Final Thoughts: Budgeting Means Freedom

A good budget doesn’t limit your life — it opens it up.

When you manage your money intentionally, you gain:

- Control over your future

- Less stress around spending

- The ability to save for what truly matters

Start small. Stay consistent. And remember: budgeting is a skill you build, not something you get perfect overnight.

Leave a comment