Best Debt Method for Real People?

Paying off debt can feel overwhelming. With multiple credit cards, personal loans, or old payday debts hanging over you, it’s hard to know where to start. Two popular methods — the Debt Snowball and thGetting out of debt isn’t just about math — it’s about building momentum and staying motivated. Two popular strategies are the Snowball Method and the Avalanche Method. Both work, but the one that fits you depends on your mindset, budget, and what keeps you going.

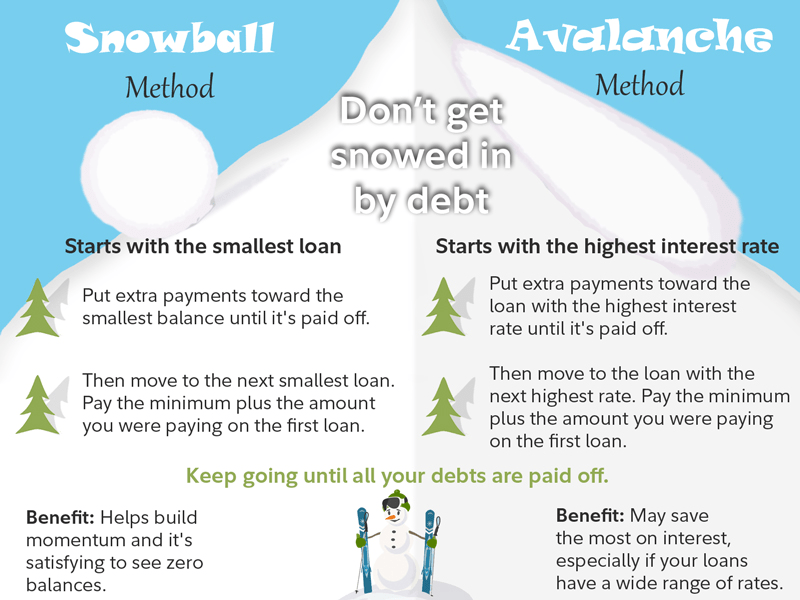

Benefits of the Snowball Method

- Helps build momentum with quick, early wins

- It’s emotionally rewarding to see zero balances quickly

- Simple and easy to follow — no need to compare interest rates

- Keeps you motivated through visible progress

Drawbacks of the Snowball Method

- You may pay more interest overall

- It’s not the most efficient method mathematically

- High-interest debts may linger longer and cost more

- Less effective if all your debts are similar in size

Benefits of Avalanche

You save more money overall.

It’s the most efficient way to pay off debt.

It helps reduce high-interest debt like credit cards faster.

Drawbacks of Avalanche

It can take longer to feel progress — especially if your highest-interest debt is large.

It requires more patience and discipline up front.

Which Method Costs More?

Here’s a simplified comparison:

- Snowball has lower short-term cost because you get quick wins, but you may pay more interest in the long run.

- Avalanche has a higher short-term cost (progress feels slower), but saves money on interest over time.

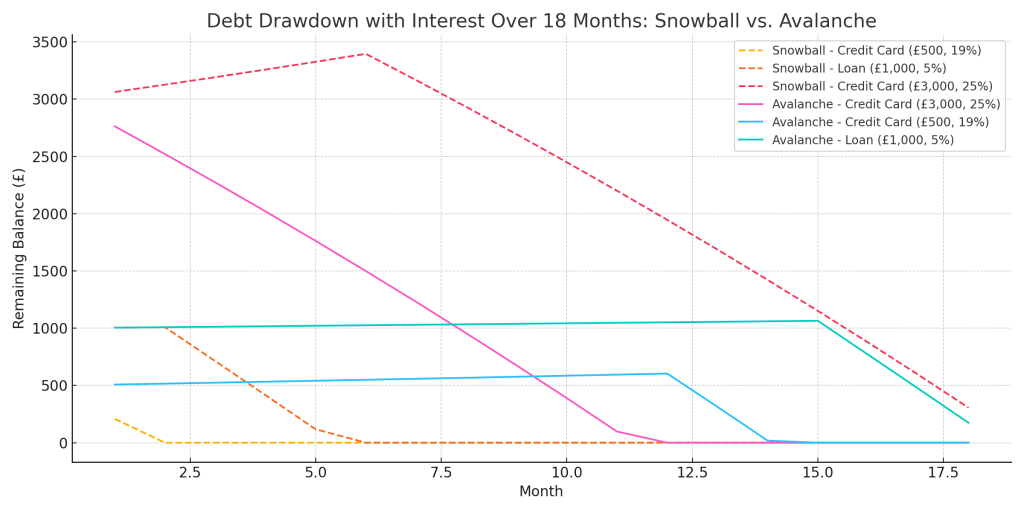

Real-Life Example: Debt with Interest

Let’s say you have £300 per month to put toward debt repayment, and the following balances:

- £500 credit card at 19% APR

- £1,000 personal loan at 5% APR

- £3,000 credit card at 25% APR

With the snowball method, you’d start with the £500 card. You’d clear it quickly, but the £3,000 card would continue to grow in interest while you focus on smaller debts.

With the avalanche method, you’d start with the £3,000 high-interest card. It would take longer to see progress, but you’d avoid most of the added interest over time.

Over 18 months, the results can be very different — even with the exact same £300/month budget.

The snowball method feels more rewarding early on because you eliminate debts quickly. But while you’re focusing on the small debts, the high-interest £3,000 card continues to grow — meaning you pay more interest overall.

The avalanche method takes longer to feel like you’re making progress, but because you’re tackling the highest interest first, you pay less over time. More of your money goes toward reducing your debt, not toward interest.

A Quick Note About This Graph

This isn’t a perfect simulation — it doesn’t account for minimum payment rules, balance transfer fees, or unexpected charges. But it illustrates something crucial:

The snowball method delivers fast wins, while the avalanche method reduces the cost of debt more effectively.

That’s why interest matters, even if it’s not always what keeps you emotionally motivated at the start. Seeing that chart side-by-side is a great way to understand the hidden cost of “waiting” on high-interest balances.

How to Maximise Any Strategy

Whichever method you choose, there’s one tactic that makes both more effective:

Once you pay off a debt, take the full amount you were paying and roll it into the next debt. So if you were paying £100 a month on a card and clear it, start putting that £100 toward your next debt. That way, your progress speeds up over time without needing to increase your budget.

Which Should You Choose?

Choose snowball if you need small, fast wins to stay motivated.

Choose avalanche if your goal is to pay the least amount in interest over time.

You can also mix both: start with a small win using snowball, then switch to avalanche to save money.

The most important thing is that you get started and stay consistent. You don’t need to be perfect — just keep going.

Why Snowball Can Be Powerful

The snowball method is especially helpful if you’re on a tight budget. Small early wins create momentum, which builds confidence. Every debt you clear frees up more money to put toward the next one.

That compounding progress helps you stay committed — even when motivation is low. And sometimes, that’s more important than choosing the “most efficient” option on paper.

Final Thoughts

There’s no one right answer. What matters most is choosing a strategy that works for you — and sticking with it. Progress and consistency will always matter more than perfection.

Leave a comment